Drop-Off Filing

Steps to Drop-Off Paperwork

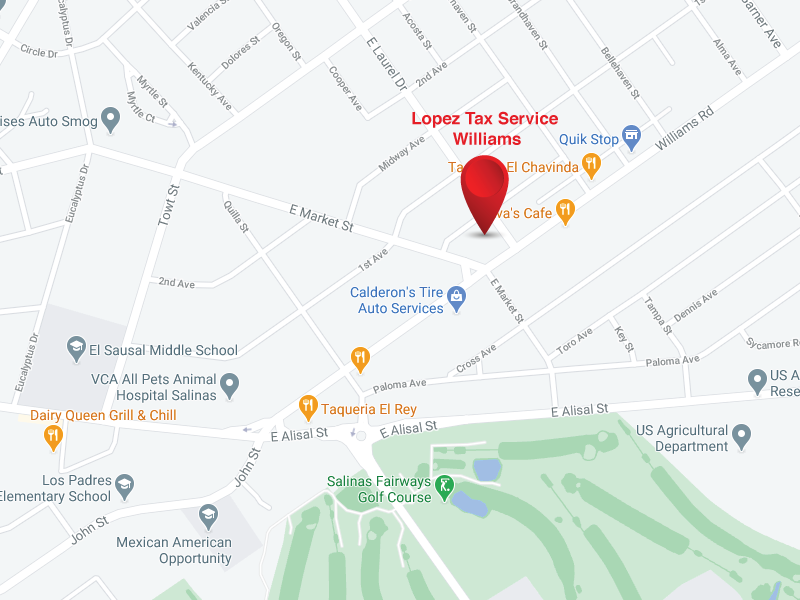

- Pick a location to drop-off your source of income form(s) (W-2, 1099-G, 1099-MISC, 1099-NEC, 1040-ES, SSA-1099). As well as dependent documents (birth certificates, ID’s, school or medical records), your identification documents, mortgage documents, and insurance.

- We will scan the documents provided and return them to you. If you would like it to be filed on the same day, please schedule an appointment here.

- You can let us know if you want a specific tax preparer, otherwise we will pick a tax preparer for you.

- Once our tax preparer has filled out the general information, we will give you a call/text to schedule a time to review your tax return.

- Our tax pro will review the tax return with you. Once approved, you will sign and pay the service fee.